WIDE DIVERGENCE BETWEEN NASDAQ AND S&P PRESENTS A DANGER

A CORRECTION IS LIKELY

A Correction Is Likely

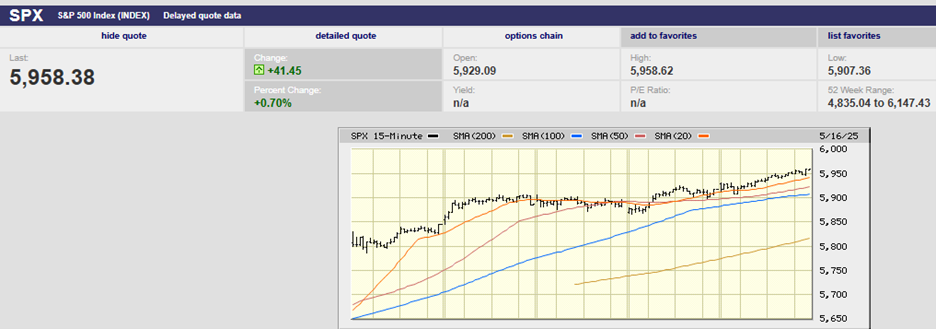

The S&P 500 and NASDAQ have ripped higher since the March 23rd low. Most stocks have not participated. The S&P 500 is down 1.4% year-to-date. It would be down 10.5% without a handful of big tech names. Apple, Microsoft, Amazon, Alphabet, Facebook, and Nvidia are driving both the S&P 500 and NASDAQ higher. The top eight stocks by market cap in the NASDAQ 100 are up 49% as a group on the year. It is a very narrow market. It is an unhealthy market.

Markets tend to revert to the mean when they get more than two standard deviations from their 200-day moving average. The NASDAQ is nearing three standard deviations from its 200-day moving average. As well, the divergence between the NASDAQ 100 and the S&P 500 is at a level it has only hit once before – 1999. A healthy rally is one with broad participation. The current rally is narrow. Less than 2% of the S&P 500 member stocks account for the bulk of the gains since the March 23rd low. Technology makes up 28% of the S&P 500 as of last Thursday. Technology represented 21.5% of the S&P 500 in November of 2016.

Do not buy the market. It is expensive. There is a high probability of a correction in both the S&P 500 index and the NASDAQ in the coming months. A pullback is likely regardless of whether we are still in a bear market or not (we think we are). Instead, look for stocks that have not recovered yet. Look for value.

Regards,

Christopher R Norwood, CFA

Chief Market Strategist