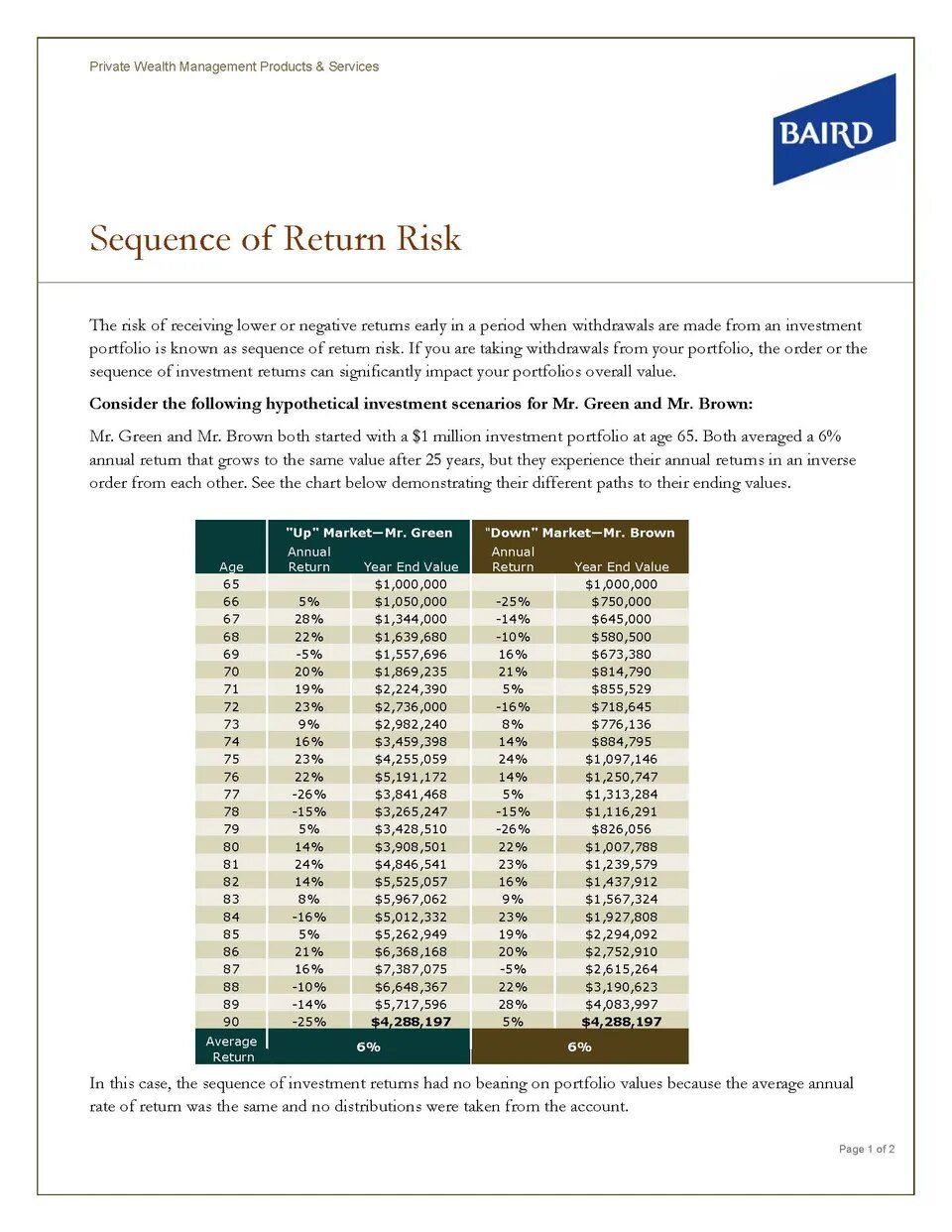

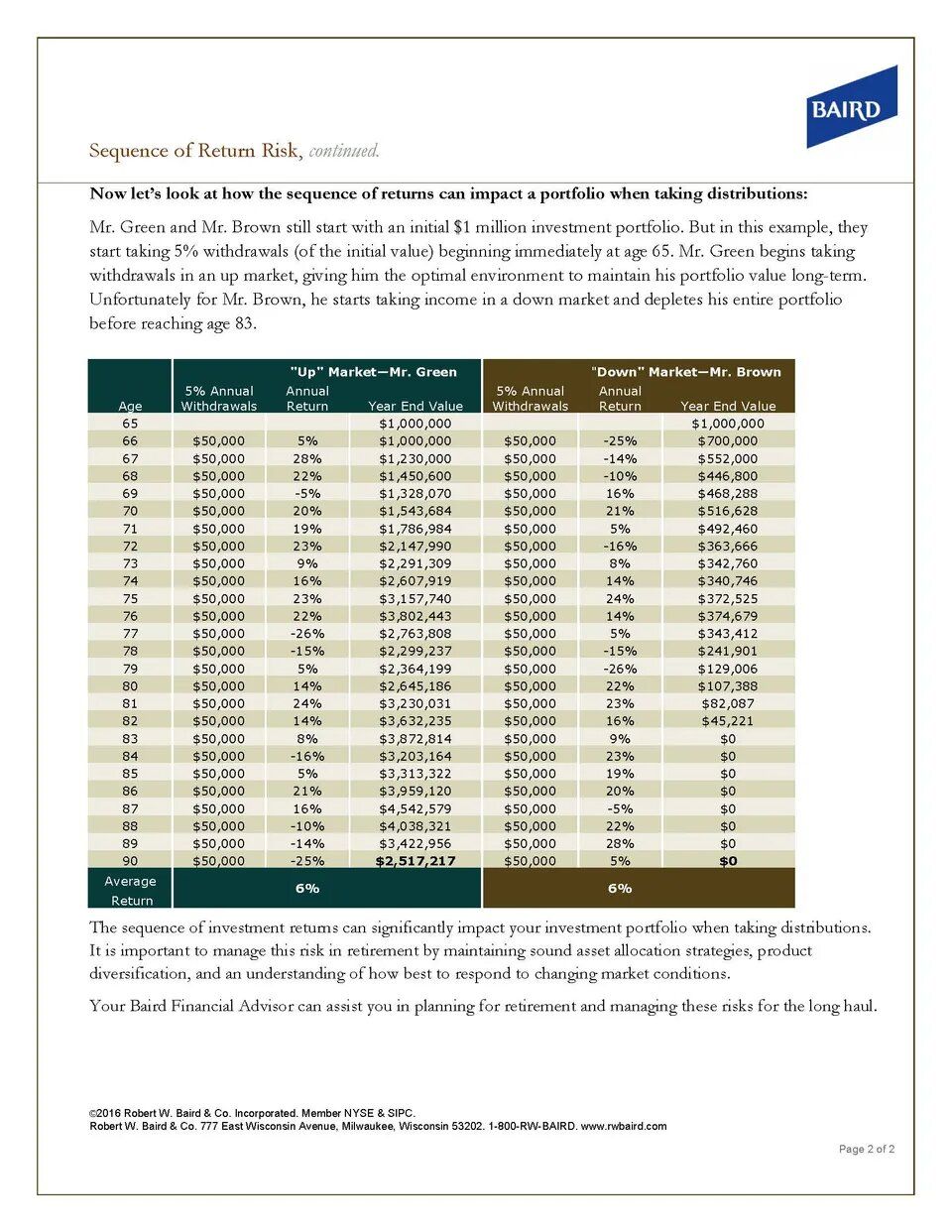

If you are taking withdrawals from your portfolio, the order or the sequence of investment returns can significantly impact your portfolios overall value.

Retirement planning done right is not easy; however, it is worth doing. In fact, people who focus their energy on picking up the pennies and nickels sometimes available in the stock market, but who ignore the dollar bills sitting on the table in plain view, often end up with a failed retirement. What does that mean?

It means that many people obsess over picking a better actively managed mutual fund, or finding a financial advisor who can add return with active management. Never mind the decades of data that show that individual security selection is by far the least important part of investing, and may just as easily result in underperforming as outperforming the various investment benchmarks. It is a fact that most people would be better off building a properly diversified portfolio of low-cost index funds and give up trying to earn additional pennies and nickels with individual security, or actively managed mutual fund selection.

Meanwhile, most people would be much more likely to experience a successful retirement if they spent more time actually planning for retirement rather than more or less winging it. We have software available now that can provide sophisticated models of your retirement, allowing us to stress test your retirement to find the holes and plug them. Of course, that assumes you’re working with a financial advisor that actually understands retirement planning and is willing to produce a detailed retirement plan for you. All too often financial advisors use an abbreviated version of retirement planning, taking little more than a cursory glance at your retirement before making a pitch to manage your portfolio. Frequently, you never hear about updating your retirement plan after they’ve got your money.

Using a reader’s digest version of retirement planning (think robo-advisors) as a means of capturing your investment portfolio is really just a marketing ploy. What do you end up actually paying for with the pseudo-retirement planning crowd - including the robo-advisors? You end up paying a fee, plus (often) commissions. In exchange the financial advisor is well paid for doing nothing more than putting your money into an investment portfolio based on a one-time risk assessment with the portfolio rarely changing in the years that follow.

Want an example of risk that can sink your retirement - how about sequence of return risk?

Sequence of return risk is exactly what it sounds like. The sequence of returns you experience matters when you’re taking distributions from your portfolio in retirement. Poor returns early in retirement can lead to a depletion of your portfolio before death. Likewise, poor returns in the five to ten years leading up to retirement will have a greater negative impact on your retirement than a similar stream of returns occurring at a younger age.

The people retiring in 2018, and those who retired in the last few years, are likely to experience sequence of return risk up close and personal. The S&P 500 is quite likely to lose money over the next three years or so, and at least some recent retirees will find themselves with a much-reduced portfolio from which they nevertheless have to take distributions to cover living expenses.

It’s not a coincidence that the fastest growing labor cohort has been the over 65-year old group since 2000. Many of the retirees from the years immediately prior to the 2000-2002 bear market and the 2007-2009 bear market quickly found their spending plans blown up by the horrible returns in the market and were forced to re-enter the work force. With the S&P 500 almost three standard deviations from fair value and the Federal Reserve raising interest rates, it’s only a matter of time before a whole new group of recently retired Americans experience firsthand the trauma of sequence return risk.

Read more below from the offices of Baird Retirement Management: