Federal Reserve Rate Hikes and You - So, what’s the big deal about interest rate changes, and what do they mean for your job and for your investment portfolio?

The Federal Reserve System (Fed) was created by Congress in 1913 to serve as the Nation’s central bank. The Fed has three main goals: keep prices stable, keep the economy at full employment, and promote moderate, long-term interest rates. The Fed also supervises and regulates the banking system to promote safety and contain systemic risk that may arise in the financial system (think the housing crisis and the near implosion of our banking system in 2007-2009).

The Federal Reserve has a number of tools at its disposal to influence the availability and cost of money and credit. Perhaps the best known tool is the Fed Fund’s Rate, which is employed by the Federal Reserve Board’s Federal Open Market Committee (FOMC). The Fed Funds Rate is the interest rate banks charge one another for uncollateralized overnight loans needed to meet capital requirements. The Fed Fund’s rate gets a lot of attention from economists and professional money managers, and the FOMC meetings usually revolve around whether the members of the committee are going to raise, lower, or leave the Fed Funds Rate alone.

So, what’s the big deal about interest rate changes, and what do they mean for your job and for your investment portfolio?

The answer is surprisingly simple: Interest rates are the price of money. The price of money goes up when the Fed raises the Federal Funds Rate. The economy eventually slows down. The economy eventually slows down because the cost of money is an input for businesses. Businesses don’t grow as fast when input costs rise. Profitability can even decline if the cost of money rises sufficiently. Some businesses will start cutting other costs, including labor costs. People lose jobs, while those already unemployed can’t find jobs. The stock market, anticipating the slowing economic growth, stops going up, and (often) starts going down. Recessions and bear markets are a very common result when the Fed is raising interest rates, and the cost of money goes up as a result.

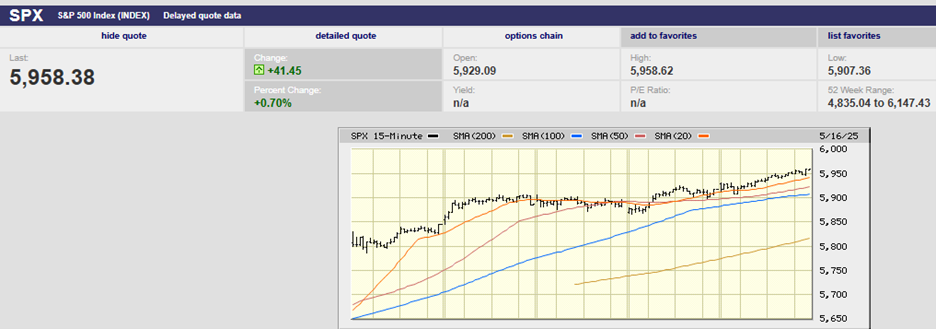

The FOMC raised the fed funds rate by 0.25% in December of 2015, and again by 0.25% in December of 2016. It raised the Fed Funds Rate three times in 2017 and has already raised rates three times in 2018. It is expected to raise rates once more in December, and three more times in 2019. The cost of short-term money has gone from effectively zero, to more than 2.25% since the Fed first started raising rates.

Expect the Fed’s interest rate hikes to slow the economy down, and quite possibly tip it into recession by the second half of 2019, or first half of 2020. The Fed wants to slow the economy down to prevent inflation. The Fed does not want a recession, but frequently engineers one when they embark on a tightening cycle because the tools at their disposal are blunt instruments at best, and unsuited to fine tuning the economy – although that doesn’t prevent them from trying.

Expect the stock market to begin pricing in a recession two to three quarters prior to the economic slowdown. Expect unemployment to begin rising two to three quarters after the economic slowdown begins.

Chris Norwood