Consumer confidence rising, inflation fears are falling

Market Update

The S&P surged to a new all-time -high on Friday, hitting 4,842.07 in late afternoon trading. It also hit an all-time closing high of 4,839.81. The media doesn’t seem to know why. Understandably so. Two headlines in Barron’s highlight financial media confusion. “How the Stock Market Forgot the Fed and Hit a New Record” read one headline. The article points out that the Fed told investors last week that it isn't easing in March. Yet stocks rose last week anyway. “The Stock Market Doesn’t Care About the Slow Start to Earnings Season,” read a second headline. That article pointed out that earnings expectations have fallen. It also relayed that corporate earnings guidance has been less than enthusiastic. Yet stocks still rose.

The S&P surged Thursday and Friday after two days of selling and finished 1.17% higher on the week. The 10-year Treasury yield responded to last week’s economic data by rising to 4.12%. The two-year rose to 4.41%. Rising yields make sense given the Fed's messaging and economic data last week. A rising stock market? Not so much.

Stocks respond to earnings and interest rates in the long run. Short-term movements result from a myriad of factors that are meaningless longer term. Those factors cancel one another out with no lasting impact. Interest rates are likely to remain higher than bond investors currently expect. Investors still believe the Fed will cut six times in 2024. They are a bit less certain when the first cut will come.

The probability of the first cut happening in March has fallen from 79% to 52%. That’s still too high. Fed governors Waller and Bostic were out last week pushing back on March rate cuts. Bostic said he doesn’t see rate cuts before the third quarter. San Francisco Federal Reserve President Mary Daly also poured cold water on a March cut. She said in an interview with Fox Business that the Fed hasn’t reached price stability. "It’s really premature to think [policy adjustments are] around the corner,” she told Fox.

The economic data doesn’t support rate cuts anytime soon. The Atlanta Fed GDPNow tool forecasts Q4 economic growth of 2.4%. Unemployment is 3.7%, which is near 50-year lows. Financial conditions have eased. A rising stock market and tight credit spreads are easing for the Fed. Prices of leveraged loans rated below investment grade have rallied sharply in recent months, according to Torsten Slok, chief economist at Apollo Global Management. Dubravko Lakos-Bujas of JP Morgan wrote recently that net liquidity has increased. He points to the rise in bank reserves from $3.2 trillion to $3.6 trillion as one piece of evidence.

Economic data last week didn’t improve the case for imminent rate cuts. Retail sales rose 0.6% in December. It is the largest increase since September 2023. Also, jobless claims fell 18,000 to 187,000. It is the lowest in 16 months, or since September 2022. The weekly jobless claims report is a leading indicator of unemployment. Currently it is indicating a strong labor market. The University of Michigan Consumer Sentiment survey climbed 9.1 in January to 78.8. It is the largest increase since 2005. Inflation expectations in the report fell to the lowest level in three years. Lower inflation expectations are likely a major reason for rising consumer confidence.

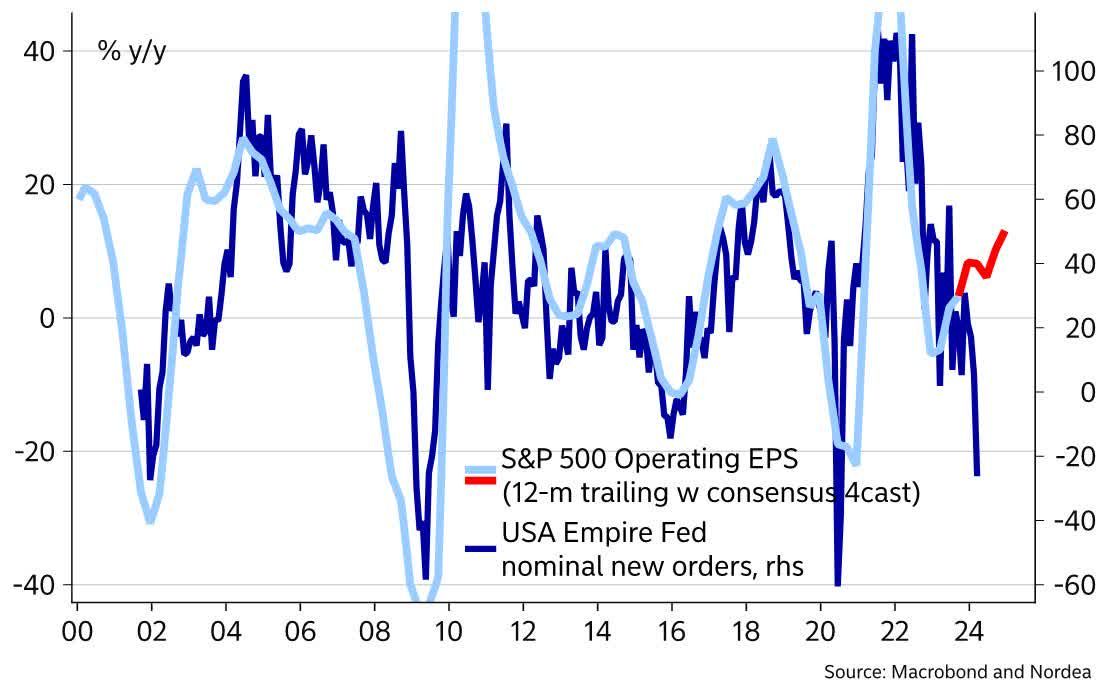

Earnings growth is the alpha and omega for rising stock prices over the long run. Earnings season hasn’t been great so far. Expectations for Q4 earnings have dropped since October 1st. Analysts were forecasting 11% year-over-year growth in EPS for Q4 at the start of Q4. That’s according to IBES data. The forecast for growth has fallen to 4.5% over the last three months.

It’s still early in earnings season though. More than 70 companies are scheduled to report this week. The following week the number reporting rises. Management will need to be more optimistic than those that have already reported. Equity valuations are rich. The S&P 500 is trading at 20.6x 12-month forward earnings (starting with Q4 earnings). The long run average P/E is 16x. The P/E has averaged around 18x during the last 20 years. Earnings growth will slow by around 1.8% going forward, per a 2022 Fed study.* Slower earnings growth means lower P/E multiples. Using a 16x P/E ratio gives an S&P 500 valuation of 3,754. Using an 18x P/E ratio gives an S&P 500 valuation of 4,222. Splitting the difference gives an S&P 500 valuation of 3,988.

*Corporate earnings benefited from falling interest rates over the last 20 years. Falling corporate taxes provided an additional boost to earnings. Neither interest rates nor taxes are likely to continue providing an earnings tailwind.

The Fed is warning investors not to expect rate cuts in March and not to expect six cuts in 2024. Earnings forecasts of 11.1% in 2024 and 12.5% in 2025 are unlikely to materialize. Falling nominal GDP and normalizing profit margins will see to it. Corporate management hasn’t been effusive so far during their Q4 earnings reports. Despite the S&P 500 breaking above resistance and setting a new all-time high…

Uncertainty is higher than normal and risk management remains paramount.

Economic Indicators

The Empire State manufacturing survey tanked last week. The NY business conditions index fell to negative 43.7, the lowest since May 2020. It’s also the second-lowest reading ever. The index has fallen 58.2 points over the last two months. Falling new orders is the main reason. New orders are a leading indicator. The national manufacturing sector has contracted for 14 straight months, according to the ISM Manufacturing report.

Liz Ann Sonders, is the Chief Market Strategist for Charles Schwab

Meanwhile, retail sales jumped in December. Sales rose 0.6%. The November and December retail sales reports point to a better-than-expected holiday shopping season. Consumer sentiment climbed to the highest level since July 2021, according to MarketWatch. The 9.1-point rise in the gauge to 78.1 was due to lower inflation, cheaper gas, and a boost in optimism about the economy according to the report. Initial weekly jobless claims fell to 187,000 from 203,000. The labor market continues to be strong.

The Consumer Conference Boards' coincident economic index (CEI) is still rising. The CEI and low weekly jobless claims point to an economy that shows few signs of falling into recession. The Consumer Conference Board is forecasting recession in the second half of 2024. That forecast is threatened if coincident indicators don’t begin to weaken soon.

Long-term Care and Estate Planning

I was in Pennsylvania Friday and Saturday helping my brother and sister-in-law with my mom's house. She is transitioning to an adult living facility. The house has been in the family for some 80 years. It was my grandma’s house until she died in the 1990s. My mom moved in to help her those last few years. She stayed after grandma died.

Lots of memories in that house. Old pictures, fiberglass balls from the nearby train track, yarn used by my grandma for knitting, fifty-year-old coats hanging in an amour in the attic.

We'd show up every Wednesday before Thanksgiving after a long drive. My grandma would always cook a big dinner. A turkey with a half dozen sides. It was in her house I learned to love pickled eggs. It was a wonderful day of family, football, and a feast. By Sunday we were heading home after having had all sorts of fun. Now the house is being sold. It is the end of an era in my family.

My mom doesn’t want to sell the house. She knows she needs to though. She doesn’t want to give up her independence and move into senior living. But she can’t live by herself anymore. Hard decisions. Painful decisions.

Elder care, estate planning, financial planning, call it what you will. The last few years in many people’s lives hold similar experiences. The slow decline. The realization that a loved one is no longer able to live alone. The conversations adult children must have with elderly parents. An orderly transition from independence to something less is rarely without bumps. It often isn't orderly at all. A lack of planning. Insufficient communication. Insufficient funds.

We're selling mom's house to help pay for her senior living facility. She has a pension and receives social security. It isn't enough. She has an investment portfolio that will cover costs for maybe two years. Her income will stretch that perhaps to three. Proceeds from the house will cover another 18 to 24 months. She's 90 years old. Her assets will last five to six years. She could live to be 100. She’s spry for her age, and there’s nothing wrong with her mind. Fortunately, the senior living facility is affiliated with an organization that will cover her costs once the money runs out. It's a critical safety net for her.

Humans don't like to think about their own deaths. We avoid planning for our last years. We avoid having those difficult conversations with our adult children. Adult children avoid having those conversations with their elderly parents. Wills should be reviewed. Power of Attorney documents drawn up. Guardians appointed for those younger families with minor children.

Everyone needs an exit strategy. We are all exiting sooner or later after all.

Regards,

Christopher R Norwood, CFA

Chief Market Strategist