Value investing means buying good companies on sale.

Value investing takes patience.

Market Update

The S&P 500 rose 0.2% to close at 4,604.37. We did get that new 52-week high, just not on a closing basis yet. The S&P inched above 4,607.07 in the last 30 minutes of trading Friday but couldn’t hold that level into the close. The S&P is running into stiff resistance. It has hit highs of 4,587.64, 4,569.89, 4,599.39, 4,572.37, 4,590.74, 4,590.92, and 4,609.23 in the last eight trading sessions. The index is overbought but hasn’t pulled back. Investors want to take the market higher. It’s a question of whether buyers can chew through the selling until a breakout is triggered. They may well succeed. The other possibility is that the market begins to fall as traders take profits. They will only push against a wall so long before deciding to lock in their gains. And profits are substantial coming off the October 27th 4,103.78 low.

The 10-year Treasury yield ended the week at 4.23% up from 4.22%. The bond rally that unwound the previous sharp rise in yields appears to be over. Yields rose rapidly for the three months ending in October, peaking at 5% for the 10-year Treasury. November saw long-term bonds catch a strong bid. Yields in November round-tripped back to where they started in August. The question is where will interest rates and earnings go from here?

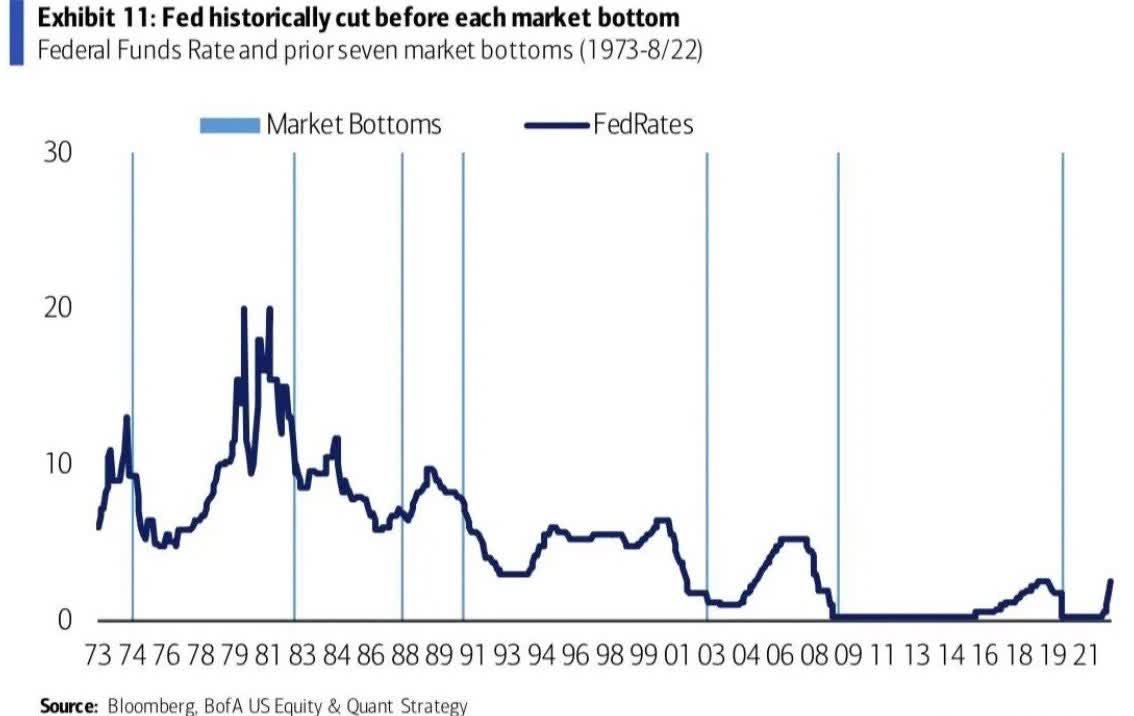

The Fed is expected to hold the funds rate steady at its meeting this week. The CME FedWatch tool shows a 97.1% chance of the Fed standing pat. The FedWatch tool places the odds of a cut in March at 43.2%. The futures market sees a high likelihood of several rate cuts by the June meeting, perhaps as many as three. The FedWatch tool forecasts at least four cuts in all 2024.

J.P. Morgan chief U.S. economist Michael Feroli doesn’t agree. He writes in a client note that there will likely be two quarter-point cuts implied in the FOMC’s dot plots for end-2024. That would be a quarter-point below the September median projection of 5.1%. But that remains far above the 4.31% Fed funds rate implied by the December 2024 FedWatch tool forecast. And therein lies the problem. The Fed is signaling that rates will stay above 5% through 2024. The market is pricing in much lower rates by year end 2024. Investors could react badly if the Fed doesn't lower its Fed funds forecast this week.

The Fed might do that this week. But how much lower is the next question up. Bank of America economists have pointed out that the Fed and investors disagree on the neutral rate. The neutral rate is the real rate that neither stimulates nor restricts the economy. The market thinks the “neutral" rate is well above the 0.5% presumed by the FOMC. Bank of America economists note that the market projects the Fed’s key policy rate to be around 4% in 2026. Yet the Fed itself has the neutral rate at 0.5% which would put the Fed Funds rate at 2.5% in 2026 not 4%. A Fed funds rate of 4% implies that the neutral rate is 2% after accounting for 2% inflation. Why does it matter? Because a growing number of economists believe the Fed funds rate will need to stay around 4%. These economists believe the neutral rate is now 1.5% to 2.0% rather than 0.5%. A higher Fed funds rate means a higher cost of money. A higher cost of money means reduced aggregate demand. Reduced aggregate demand means slower growth.

Meanwhile, earnings are expected to rise by 11.3% in 2024 and 12.0% in 2025. Last week we pointed out that a 2022 Fed paper is predicting slower real corporate earnings growth. The paper shows that lower corporate taxes and lower interest rates increased real earnings growth by a third over the last two decades. Those two tailwinds are gone. The author of the Fed paper, Michael Smolyansky, estimates real corporate profit growth of 3.0% to 3.5% going forward. That is almost 2% slower than during the last twenty years.

There is more bad news on the corporate earnings front. There is a robust empirical relationship across countries over time tying growth rates to debt levels, according to Adam Posen, president of the Peterson Institute for International Economics. Higher government interest costs as a share of GDP crowd out private- and public-sector investment. Crowding out results in low innovation, a low rate of productivity growth, and a low rate of growth overall,” Posen says. Drs. Reinhart and Rogoff found the same in their research published in “This Time Is Different: Eight Centuries of Financial Folly”

U.S. interest costs doubled from 2020 to 2023. Interest costs are the fastest-growing area of government spending. The U.S. is on track to spend more than $13 trillion on interest over the next decade according to the Congressional Budget Office.

In the meantime, it is likely that the Fed funds neutral rate is in the 3.5% to 4% range, well above the Fed’s estimate of 2.5%. Interest rates may well stay higher than many investors are currently anticipating. It’s a certainty that the Fed will stand pat at the meeting. It is far less certain what Powell will say in his press conference and what changes are coming to the Fed’s dot plot. The coming week may see volatility rise from low levels.

Regardless, for now, the path of least resistance is higher for the stock market.

Uncertainty remains high and risk management a priority.

Economic Indicators

The S&P jumped at the open Wednesday. The media pointed at the weaker than expected ADP employment report. We wrote last week that a weak payrolls report would send yields lower, which it did. The up opening in the stock market was sold hard though. The index peaked at 4,590.74 in the first 15 minutes of trading. It hit a low of 4,546.50 late on Wednesday.

Nonfarm payrolls increased by 199,000 in November, better than expected. The forecast was for 190,000, up from last month’s 150,000. The unemployment rate fell to 3.7% from 3.9%, back near 50-year lows. The payrolls report may impact the Fed's guidance this week. The labor market is tight. Wage growth is running at 4%.

The FOMC will outline its best guesses in its Summary of Economic Projections, or SEP, for 2024 and beyond following the meeting. “The market is definitely running ahead of the Fed,” John Ryding, chief economic advisor for Brean Capital and former staff economist for the Fed and Bank of England, told Barron’s. The Fed’s current dot plot has a hike in December and two rate cuts in 2024. The December hike won’t happen. We’ll have to see how different the Fed’s forecast is from the markets.

The widely watched U. Mich. preliminary December consumer sentiment index jumped to 69.4 from 61.3 in November. The rise in consumer sentiment is a plus for the economy. Inflation expectations for 2024 fell to 3.1% from 4.5% in the same report. The drop in expectations does give the Fed some room. Well anchored inflation expectations are a prerequisite to keeping inflation low.

Managing A Stock Portfolio And Managing for the Long-Term

Chasing short-term returns is hard. Most money managers don’t do it well. The idea with short-term investing is to stay out in front of the business cycle. Buy what's about to go up and sell what's about to lag. It sounds good in theory but is hard to do in practice.

It was widely understood that the economy was going to recover in 2021 and 2022. The Covid recession was in the rear-view mirror. The Federal Reserve had cut rates to zero. The federal government was passing large fiscal stimulus packages. Focus on stocks that benefit the most from an improving economy. Buy technology and consumer discretionary. Fast forward to a slowing economy. The Fed is tightening and fiscal stimulus waning. Rotate into consumer staples, health care, and utilities. Get out of what might go down and into what might go up. Short-term investing in a nutshell. It does sound like an attractive strategy.

The problem is it is hard to get the timing right. Many mutual fund managers don’t. Perhaps that’s one of the reasons mutual funds don’t outperform passive investing. It’s definitely why mutual funds have such high turnover. I haven’t looked in a while but a decade or so ago the turnover was approaching 100%. Not very tax efficient and not very successful.

Value investing is about going the other way. Buy what everyone else is leaving behind. Buy because it’s a good company on sale not because the stock might rise in the next six months. Value investing is about buying out of favor companies and then waiting. The market will reprice these undervalued companies eventually. Chasing short-term performance is hard. Buying good companies on sale is easy. Having the patience to wait for the returns to come? Not so easy.

And then there is seeing how the sausage is made. Owning individual stocks is different than owning mutual funds. Individual stocks are more volatile. They can swing from gains to losses and back to gains at a dizzying rate. All stock portfolios will have losing positions in them. Losses of 20% to 30% are not at all uncommon. Short-term forces push stocks up and down. Noise accounts for almost all stock price movements in the short run. Fundamentals account for the bulk of returns over the long run. For instance, dividend-paying stocks are out of favor in 2023. People are selling them to chase technology and bond yields. It's a short-term factor that will reverse once the Fed starts cutting.

Many of my clients hate seeing losing positions in their portfolio. They will point to one losing position or another and ask, “Why do we own that stock?” They should be asking why we own that business. Interestingly, they never point to a stock that’s gone up and ask, “Why do we own that stock?” They should be asking if that stock is still worth owning now that the market is valuing it more highly. It is a truism that stocks that have gone up are more dangerous to own than stocks that have gone down. A business that is carrying a higher valuation is more at risk of disappointment. The reality of value investing is that we are often sitting on losses after we buy. It's no easier timing an individual stock than the entire market.

A whole generation of investors has grown up investing mostly in mutual funds. Mutual funds rarely have losing years because the stock market rarely has losing years. Mutual funds often own hundreds of stocks, smoothing out volatility. Investors are no longer familiar with the volatility of individual stocks.

We do make mistakes. Every portfolio manager does. But I am inclined to buy more when a holding falls if the long-term fundamentals haven’t changed. Where clients see an unwelcome loss, I see the potential for larger profits.

Regards,

Christopher R Norwood, CFA

Chief Market Strategist