The Fed is on hold “for some time”

Market Update

The S&P 500 rose 1.0% last week to finish at 4,559.34. The Nasdaq rose 0.9%. The 10-year Treasury ended the week yielding 4.48%. The two-year Treasury finished at 4.97%. It’s noteworthy that the two-year Treasury yield is sticking near 5%. It seems that the bond market is buying into the Fed’s higher-for-longer mantra to an extent.

Meanwhile, the volatility index (VIX) closed the week at 12.46, a new 52-week low. Volatility can stay low for a while as investors revel in a rising market. Fear diminishes when markets rally. Volatility will rise when the stock market next starts to struggle. Investors seeking downside protection from the options market are willing to pay up when markets are falling. Volatility is a big part of the options pricing formula. The VIX is a good measure of investor fear and right now investors are complacent.

Volatility might not rise until after the holidays though. The S&P has risen 70% of the time from Thanksgiving through New Year’s Eve since 1950 according to Barron’s. The average gain has been 1.7%.

The short-term direction is up into year-end. We wrote last week that, “the 52-week high is only 2% away. And the (almost always) Christmas rally is right around the corner. The odds favor at least an attempt to take out the 52-week high.” The new 52-week high we didn’t reach last week might happen in the coming week. The S&P need only gain 1.1% to surpass the 4,607.07 high hit on 27 July. The odds favor a new 52-week high before year-end. But a pullback is in the offing regardless of whether 4,607.07 is surpassed first.

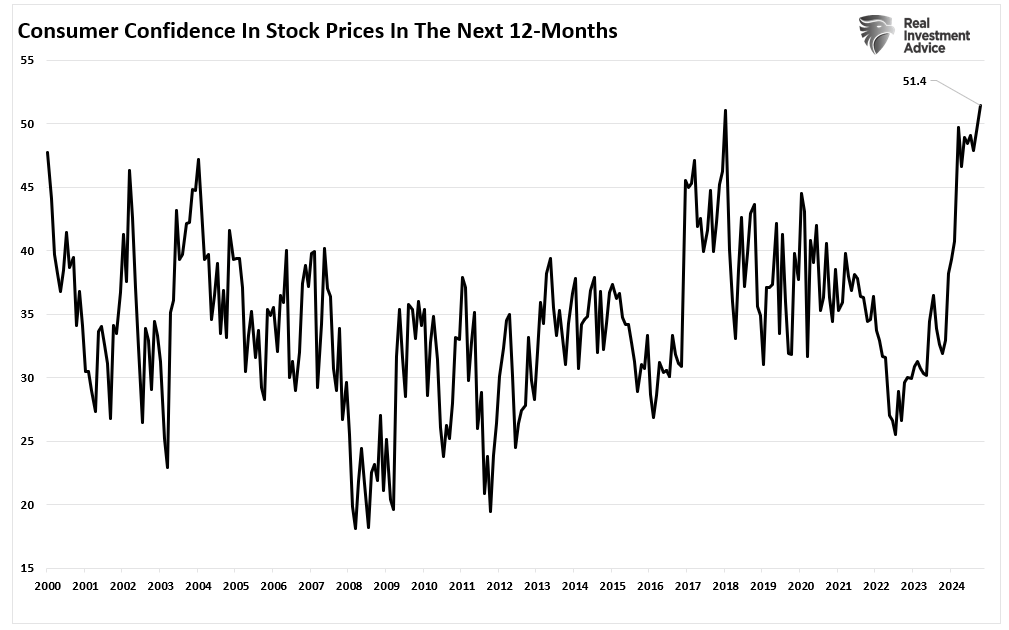

The panic buying since the S&P bottomed at 4,103.78 on 27 October makes a pullback more likely. Three large gaps were left during the 11.1% melt-up. Gaps get filled eventually. Panic buying is rarely rewarded by Mr. Market. The index is overbought and butting up against strong resistance. It will likely take good news on the earnings or interest rate fronts to generate enough buying to conquer resistance from 4,559 to 4,637. And it isn’t clear who is left to do the buying. Household exposure to the stock market is back to its highest level since 2008, according to a recent Gallup poll.

Good news on the interest rate front isn’t likely in the next few months. The federal government is still running massive deficits requiring heavy Treasury bond issuance. Increased supply will depress bond prices. China and Japan aren’t buying as much as in prior years. Reduced demand will also depress bond prices. The long end of the yield curve is likely to stay more elevated than otherwise.

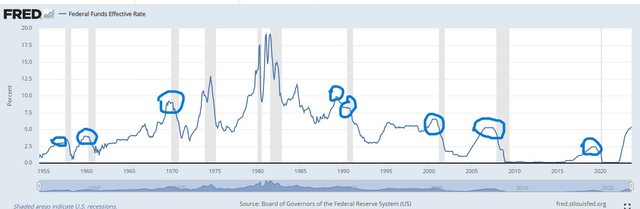

Circled areas are Fed pauses. Gray lines represent recessions. The Fed has paused, recession next?

New Paragraph